Consumer Percents | Sales Tax | Life Skills Math | Money | Calculating Percents

Sales tax is a fact of life for most of us. Only five states do not have sales tax. There is the product price, and then there is the actual price which includes sales tax.

In order for students to become smart consumers, they need to understand the concept of “sales tax” and how to calculate it. Before making a purchase, it’s important to know what an item or items actually will cost.

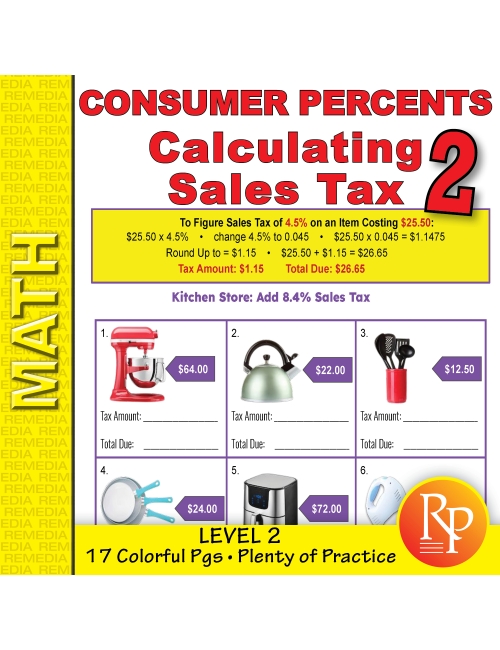

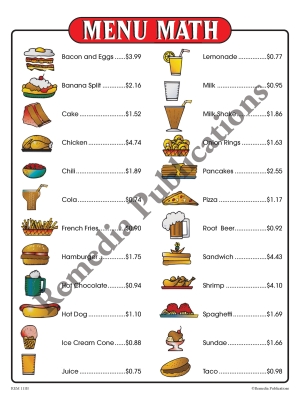

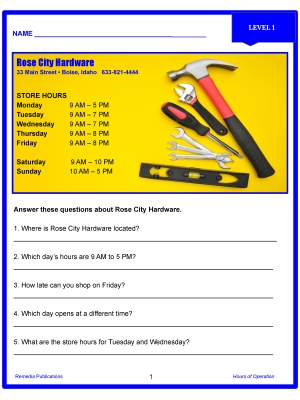

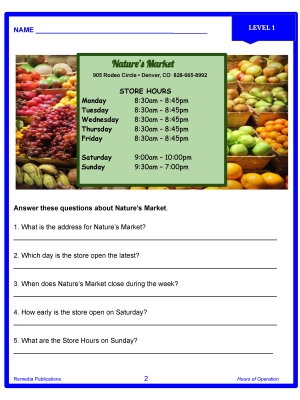

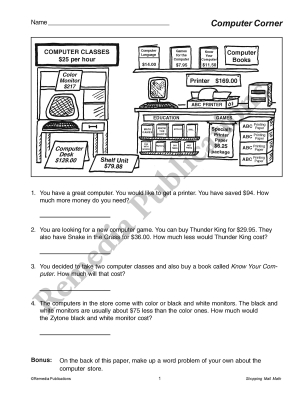

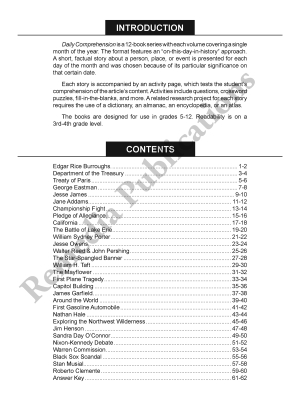

The 17 colorful, engaging worksheets in this book will give students plenty of practice calculating sales tax. Each page has a simple layout of 9 product photos and 9 prices. Students will calculate various tax amount for each price. Each of the 17 pages shows a different category of products. Each page also includes an example of how to figure sales tax.

Questions:

Level 2 activities use complex percentages to represent various sales tax amounts from 4.2% to 9.7%. The simple layout makes it easy for students to identify the product and its price and then figure out the amount of tax and the Total Amount Due.

Skills needed to complete each worksheet are being able to convert percentages into decimals and multiplying and adding money (decimals). Most answers also require the students to round up or down.

Product Categories Include:

• Bakery Items

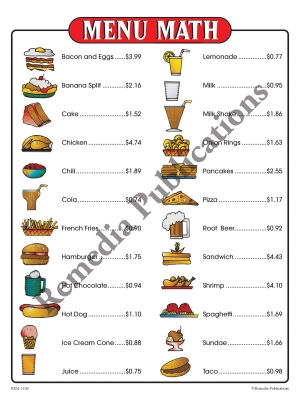

• Fast Food

• Sports Equipment

• Winter Accessories

• Garden Store

• Clothing Store

• Hardware Store

• Home Goods

• Summer Accessories

• Arts & Crafts

• Toys

• Jewelry

• Dog Products

• Mexican Restaurant

• Cat Products

• Asian Restaurant

• Kitchen Store

20 Pages

Includes Answer Key

Consumer Percents: Calculating Sales Tax - Level 2

- Product Code: EREM 97

- Viewed: 2138

- Availability: In Stock

$5.99

Consumer Percents | Sales Tax | Life Skills Math | Money | Calculating Percents

Sales tax is a fact of life for most of us. Only five states do not have sales tax. There is the product price, and then there is the actual price which includes sales tax.

In order for students to become smart consumers, they need to understand the concept of “sales tax” and how to calculate it. Before making a purchase, it’s important to know what an item or items actually will cost.

The 17 colorful, engaging worksheets in this book will give students plenty of practice calculating sales tax. Each page has a simple layout of 9 product photos and 9 prices. Students will calculate various tax amount for each price. Each of the 17 pages shows a different category of products. Each page also includes an example of how to figure sales tax.

Questions:

Level 2 activities use complex percentages to represent various sales tax amounts from 4.2% to 9.7%. The simple layout makes it easy for students to identify the product and its price and then figure out the amount of tax and the Total Amount Due.

Skills needed to complete each worksheet are being able to convert percentages into decimals and multiplying and adding money (decimals). Most answers also require the students to round up or down.

Product Categories Include:

• Bakery Items

• Fast Food

• Sports Equipment

• Winter Accessories

• Garden Store

• Clothing Store

• Hardware Store

• Home Goods

• Summer Accessories

• Arts & Crafts

• Toys

• Jewelry

• Dog Products

• Mexican Restaurant

• Cat Products

• Asian Restaurant

• Kitchen Store

20 Pages

Includes Answer Key